Half of farm households indebted according to All India Rural Financial Inclusion Survey 2016-17 of NABARD

More than half the agricultural households in the country have outstanding debt, and their average outstanding debt is almost as high as the average annual income of all agricultural households, according to a recent survey by the National Bank for Agriculture and Rural Development (NABARD).

The NABARD All India Rural Financial Inclusion Survey 2016-17 covered a sample of 1.88 lakh people from 40,327 rural households. Only 48% of these are defined as agricultural households, which have at least one member self-employed in agriculture and which received more than ?5,000 as value of produce from agricultural activities over the past year, whether they possessed any land or not.

SURVEY FINDINGS

- More than half the agricultural households in the country have outstanding debt, and their average outstanding debt is almost as high as the average annual income of all agricultural households, according to a recent survey by the National Bank for Agriculture and Rural Development (NABARD).

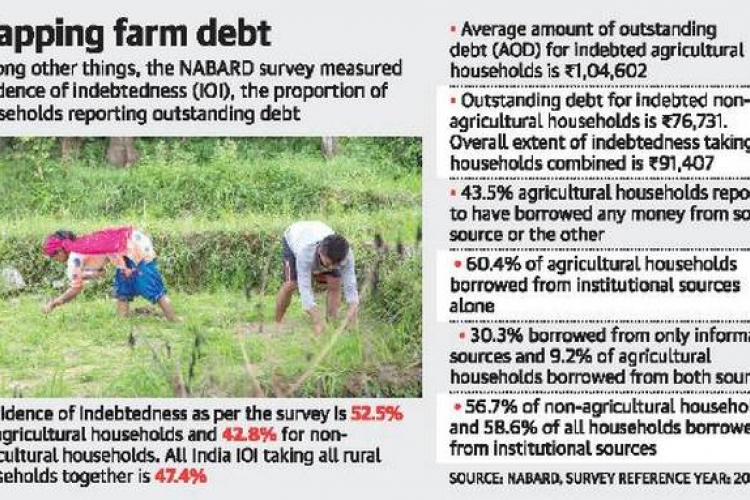

- NABARD found that 52.5% of the agricultural households had an outstanding loan on the date of the survey, and thus were considered indebted.

- For non-agricultural households in rural India, that figure was 10 percentage points lower, at only 42.8%.

Higher liability

- Agricultural households reporting any outstanding debt also had a higher debt liability compared with non-agricultural ones.

- The average debt of an indebted agricultural household stood at ?1,04,602 in comparison to ?76,731 for indebted non-agricultural households.

- According to the survey, the average annual income of an agricultural household is ?1.07 lakh. That is barely ?2,500 more than the average outstanding debt of indebted farm households.

- The survey found that only 10.5% of agricultural households were found to have a valid Kisan Credit Card at the time of the survey. The scheme aims to give farmers credit from the banks with a simplified and flexible single-window procedure. Households who had the card utilised 66% of the sanctioned credit limit, the report said.

- The biggest reason for taking loans among agricultural households was capital expenditure for agricultural purposes, with a quarter of all loans taken for this purpose.

- While 19% of loans were taken for meeting running expenses for agricultural purposes, another 19% were taken for sundry domestic needs. Loans for housing and medical expenses stood at 11% and 12%, respectively.

- While all classes of farmers had debt, the highest incidence of indebtedness came from those owning more than two hectares of land. In that category, 60% of households are in debt.

- Among small and marginal farmers owning less than 0.4 hectares, slightly less than 50% of the households were in debt. Those with more land were more likely to have multiple loans.

- “This may be attributed to the fact that these economically better-off households are more eligible for taking loans as they have enough assets to serve as security against the loans taken,” the survey report said.

State figures

- The southern States of Telangana (79%), Andhra Pradesh (77%), and Karnataka (74%) showed the highest levels of indebtedness among agricultural households, followed by Arunachal Pradesh (69%), Manipur (61%), Tamil Nadu (60%), Kerala (56%), and Odisha (54%).

- Looking at loans taken between July 2015 and June 2016, the survey found that farm households took less than half their loans from commercial banks. While 46% of the loans were taken from commercial banks, and another 10% from self-help groups, almost 40% were taken from non-institutional sources such as relatives, friends, moneylenders and landlords.

- While loans from relatives and friends may be free of interest and reflective of social integration in communities, the survey noted that “a sizeable 11.5% households exhibited dependence on local moneylenders and landlords, which exposes them to exploitation by having to pay exorbitant interest. The persons resorting to local moneylenders often include, either the illiterate or extremely poor ones which are not eligible for loans from formal institutions, or the households that do not have social networks that can help them in times of need.”

EFFECTS OF INDEBTEDNESS

1) Deterioration of agriculture:

As a result of indebtedness the farmers are not able to improve the agricultural produce. They are also not able to earn goes to the pocket of the money lenders. In fact they have to serve like servant of the money lenders. All these factors contribute to the deterioration in agriculture which ultimately has an adverse effect on the economy of the country.

2) Slavery and bonded labour:

As a result of indebtedness the farmers have to work as slavers of the money lender. Money lenders take advantages of the indebtedness and the weakness of the farmers and dispossess them of their land. Once the farmer has been dispossessed of his land he becomes an ordinary laborers. Sometimes money lender also uses the debt as an angle for catching farmers to serve as their slaves and bonded labor. In villages, several farmers have been turned into slaves and bonded labors.

3) Low standard of health of farmers:

As a result of the burden of indebtedness the farmers neither able to look after their health nor they are able to get proper diet. This makes them weak because of weakness they are not able to put in the required labour and to their income goes down. On the other hand in order to pay the debt and also to make both their ends meet, they have to work extra hard. This extra hard work tells roughly on their health and sometimes brings about pre mature death. Indebtedness has an adverse effect on the health of farmers and so the rural economy goes down

4) Poverty:

The consequences of indebtedness are the poverty. Neither they are able to improve the agriculture nor their earnings. They work extra hard and spoil their health. Because of their low income they are not able to get nutritive diet. This has an adverse effect on the economic condition of the farmers. In fact, it all adds to the poverty of the village people.

5) Psychological frustration:

Since the village people in spite of hard labour are neither able to repay the leaner are they able to improve their economic condition. This has an adverse effect on their mental set up a get frustrated. This frustration in it’s from has an adverse effect on the health of the farmers. All these things put together create further complications for the village people.

Ways and means to remove the consequences of rural indebtedness:

Several committees and commissions have been set up to study the problem of rural indebtedness various organisation and institution have also conducted surveys and put forward suggestions for removing village indebtedness some of the labour suggestions put forward in this regard are—

1) Moratorium on the existing debts and releasing the farmers from the clutches of indebtedness:

The best thing for releasing from the burden of the debts would to be place a moratorium on existing debts. Legislation should be enacted prohibiting the realisation of the debts partially it has been done. Some of the classes of the rural societies have been granted immunity against the debts and money lenders cannot realise there loans through the court of law. But his is only a partial measure. The measure should be taken as a part of comprehensive economic measure that would solve the problem of rural indebtedness, patch work would not do.

2) Alternative arrangement for loan to the farmers at nominal rate of interest:

The basic thing is to arrange for loan to the farmers. In this respect Government have also taken various steps. Banks and other institutions have started giving loan to the farmers for improving the agriculture. Apart from it co operative societies have been set up for providing loan to the farmers. Then land mortgage banks and such other banks have set up for providing an opportunity to the farmers to get loan for improvement of their agriculture.

The rate of interest to be charged by these alternative arrangements should be only normal. The rate of interest that is charged by these bodies that are providing loans to the farmers cannot be called nominal only management of loans at normal rate of interest would solve the problem of rural indebtedness.

3) Co-operative Credit Societies and facilities for loan from banks:

In village cooperative societies should be formed and greater facilities for loans should be made from banks. Both these facilities are given at present from banks. Both these facilities are given at present from these institutions but their working is not satisfactory. There working should be streamlined so that the real purpose of freeing the farmers from the clutches of the money lenders can be achieved.

4) Law against dispossession of land:

Money lenders use their loans as an agency for dispossessing the farmers of their landed property. If law is passed against the dispossession of land in account of loan by a money lender many of the problems would be solved. Certain Government measures have also been taken in this respect but more comprehensive measures have also been taken in this respect, but more comprehensive measures and their proper implementation is necessary implementation of these measures should be free from the effect of red tapism and this would solve the problem.

5) Control over the rate of interest:

There should be control over the rate of interest to be charged by the money lenders from the rural people. Though legislation Government have imposed certain ceilings on the rate of interest but for complete relief to village people from the indebtedness this rate has to be closed further and brought to the level of being called nominal.

6) License for the moneylenders and checking their accounts and income:

Only those persons who hold a license should be allowed to advance loans to the village people. Government should device ways and means and also machinery to check the accounts of these people. In other words their income should be subjected to necessary taxation. This would not allow the money lenders to preplan. This should be imposed a restriction on their amassing black money. In fact what is needed is greeter check and control on black money. Once it is done the problem of money lenders in the villagers shall automatically be solved.

7) Educate the farmers about the evil effects of some of the factors the add to the indebtedness:

The village people become indebted because of their extravagant habits. They spend a lot of money on various social customs and ceremonies. They should be educated also the evil effects of these practices. Once the villagers know all these things they should not be prepared to borrow money for these practices. This would automatically solve the problem of indebtedness.

8) Education of the farmers:

What is needed is to make farmer literature and educated. Once they become educated they shall be able to know various difficulties and the complications of the indebtedness. Education would be the best method for teaching the farmers about various social problems. One of the important causes of several evil practices in the village’s society is lack of education and illiteracy. If this difficulty can be overcome various problems of the Rural Society including indebtedness shall be solved.

IAS -2025 Prelims Combined Mains Batch - III Starts - 14-04-2024

IAS -2025 Prelims Combined Mains Batch - III Starts - 14-04-2024