Bank Recapitalization- Explained !

IN NEWS

The government on February 20, announced final recapitalisation tranche amount of Rs 48,239 crore for as many as 12 public sector banks, in a bid to take them out of Reserve Bank of India’s (RBI) prompt corrective action framework.

As per the recapitalisation drive, the government has categorised the banks in three categories with respect to their capital position as against that required by the RBI.

1.Better Performing PCA Banks to stay above regulatory PCA threshold

2.PSBs that have exited PCA but should remain so

3.Minimum regulatory capital for remaining PCA PSBs

What is Prompt Corrective Action?

PCA norms allow the regulator to place certain restrictions such as halting branch expansion and stopping dividend payment. It can even cap a bank’s lending limit to one entity or sector. Other corrective action that can be imposed on banks include special audit, restructuring operations and activation of recovery plan. Banks’ promoters can be asked to bring in new management, too. The RBI can also supersede the bank’s board, under PCA.

RBI introduces Prompt Corrective Action when the Bank’s financial conditions worsen below certain limits (trigger points).

The PCA framework specifies the trigger points or the level in which the RBI will intervene with corrective action. This trigger points are expressed in terms of parameters for the banks.

The parameters that invite corrective action from the central bank are:

Capital to Risk weighted Asset Ratio (CRAR)

Net Non-Performing Assets (NPA) and

Return on Assets (RoA)

Leverage ratio

When these parameters reach the set trigger points for a bank (like CRAR of 9%, 6%, 3%), the RBI will initiate certain structured and discretionary actions for the bank. Along with this, leverage of banks also will be monitored.

The some of the structured and discretionary actions that could be taken by the Reserve Bank are: recapitalization, restrictions on borrowing from inter-bank market to steps to merge/amalgamate/liquidate the bank or impose moratorium on the bank if its CRAR does not improve beyond etc. The corrective actions are tough with worsening of the financials.

What is Bank recapitalization?

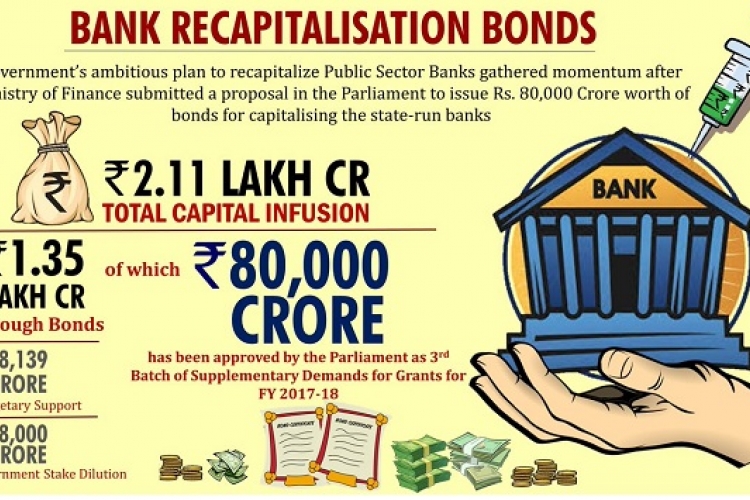

Bank recapitalisation via special recapitalisation bonds is an approach the government used in the 1980-1990.The government infused Rs204 billion into public sector banks via recapitalisation bonds.

In other words, government issue funds to the banks through recapitalization bonds. These bonds can source its fund from either govt,market or RBI reserves.In future, the government will sell the bonds to reduce its debt liability by recollection of the given fund,usually in long term debt.

Analysis

Where the funds come from ?

It is unclear whether the fund will be from the interim dividend or RBI reserves.But the PSU banks disproportionately share the burden of non-performing assets. Recapitalisation of these banks would help them to extend fresh credit and thus support credit growth.

However, being a long-term debt, it provides time to banks to improve their balance sheets by increasing their credit and private investment. As the banks’ situation gets better, the government can then retire the debt from the proceeds by selling the bank equities which it purchased earlier.

Will it reduce NPA ?

1.The recovery process set up through the Insolvency and Bankruptcy Code reform had not been working at the desired pace.Till the recovery process gathers momentum, more capital would be required. There is also a time dimension associated with this equation.

2.Recap move could give the banking system a good breathing time to enhance its credit portfolio and restore value out of the NPA accounts.

3.The quality of governance will play a significant role here.As long as the government wants to hold on to 51% equity in PSBs we cannot have periodic injection by way of recap bonds.This move will increase accountability and competition in the sector.

IAS -2025 Prelims Combined Mains Batch - III Starts - 14-04-2024

IAS -2025 Prelims Combined Mains Batch - III Starts - 14-04-2024